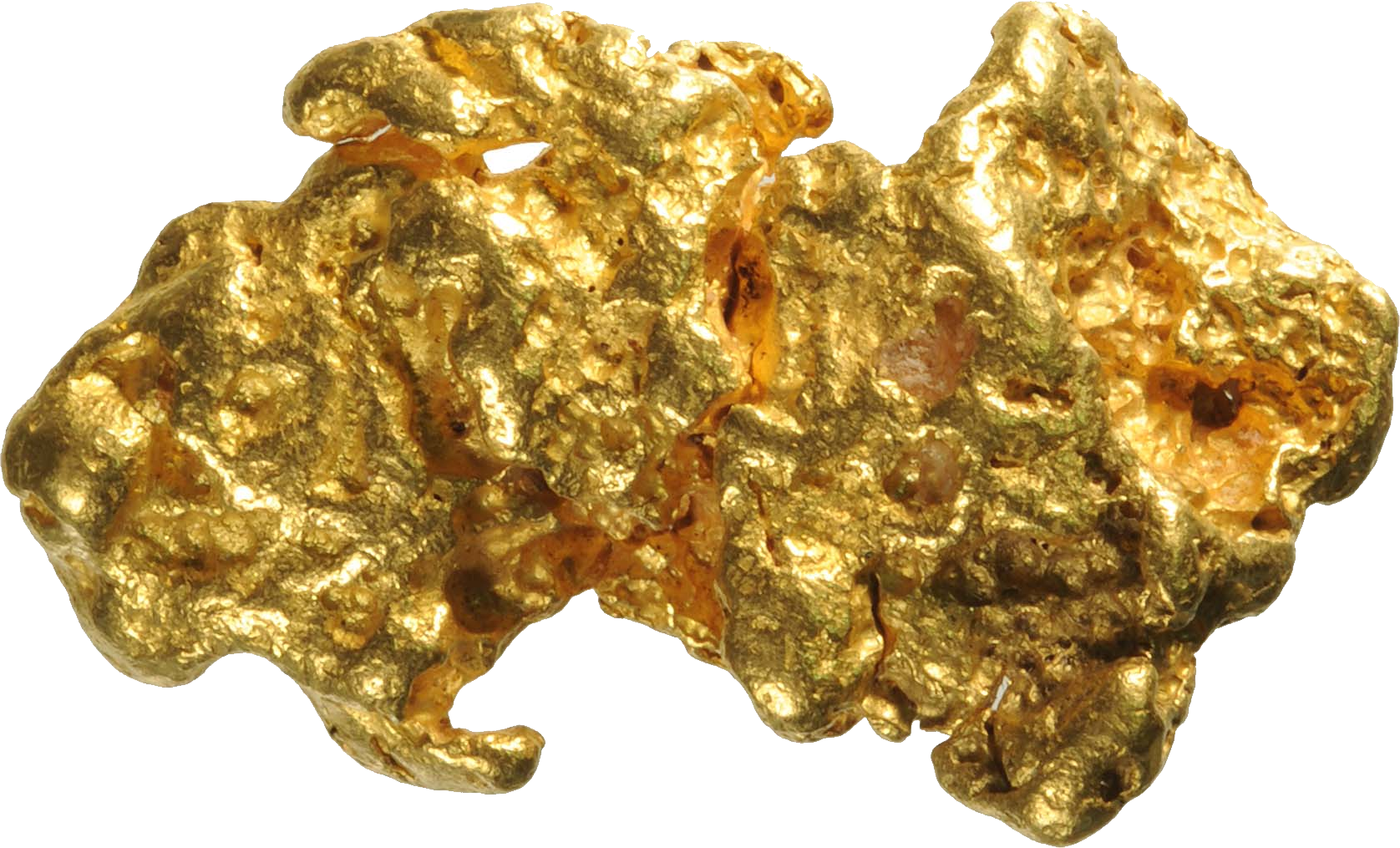

Gold has been one of the most valuable precious metalsthroughout human history, used by elites as a symbol of wealth for centuries due to its rarity and its ability to hold its worth for a long time. Historically, it has been the most common way to pass on one’s wealth as an inheritance from one generation to the next. Gold is considered a worthy investment, with coins and bars available for purchase in various sizes, ranging from one gram to a whopping 400 ounces. Being the most reliable investment commodity available, gold has proven to be a perfect way to diversify your investment portfolio and an excellent safeguard against volatile currency

Commonly seen as a great store of wealth, this precious metal is also known as a reliable safe-haven asset. With a rich history amongst almost all global cultures, gold remains a highly popular investment. Although it has multiple uses, its primary function is typically to hedge against inflation in an often volatile futures market, as well as to diversify existing Precious Metals Investment Retirement Accounts. Gold has been one of the most valuable precious metals throughout human history, used by elites as a symbol of wealth for centuries due to its rarity and its ability to hold its worth for a long time.

Historically, it has been the most common way to pass on one’s wealth as an inheritance from one generation to the next. Gold is considered a worthy investment, with coins and bars available for purchase in various sizes, ranging from one gram to a whopping 400 ounces. Being the most reliable investment commodity available, gold has proven to be a perfect way to diversify your investment portfolio and an excellent safeguard against volatile currency.

To make a profit, buyers of physical gold are wholly reliant on the commodity’s price rising. This is in contrast to owners of a business (such as a gold mining company), where the company can produce more gold and therefore more profit, driving the investment in that business higher. You can purchase gold bullion in a number of ways: through an online dealer such as APMEX or JM Bullion, or even a local dealer or collector. A pawn shop may also sell gold. Note gold’s spot price – the price per ounce right now in the market – as you’re buying, so that you can make a fair deal. You may want to transact in bars rather than coins, because you’ll likely pay a price for a coin’s collector value rather than just its gold content. (These may not all be made of gold, but here are 9 of the world’s most valuable coins.)